Inflation: Key Weapons To Avoiding It

In this article, you are about to learn how to the ultimate guide to avoid inflation. We will give you the weapons you need to be on the good financially during this time. Planning is the key weapon to avoiding this crisis.

What Is Inflation?

Inflation is defined as a continuous, general increase in prices and a fall in the purchasing value of money. In other words, it is when the cost of goods and services goes up, and the value of money goes down.

Introduction

Inflation is most often associated with currency. But it can also increase interest rates, cause decreases in the purchasing value of stocks and commodities, or require a higher level of government budgeting for services, education, and food.

We can start by saying that an increase in price affects the middle class, seniors, and single parents first and worst of all. They will be directly hit by the increasing national debt and higher levels of budget appropriation, and in silence rely on more workers’ income to survive.

For the rest, inflation can slightly increase the expenses if any person acquires at least one of the following: Increase public services using government resources such as purchasing various taxes and accommodations used. Increase prices of products or services.

National Debt Does Not Bode Well for the Future

Between 2002 and 2017, the average Social Security benefit per retired American was $16,867. This means that the average retired American can expect to collect $16,867 per year in Social Security benefits for the rest of their lives. If inflation is currently running at approximately 3.2 percent and the U.S. economy is healthy, the American population should have seen a 3.2 percent increase in Social Security benefits in this period of time.

However, in 2007 and 2008, the Republican-controlled Congress impaired Social Security by cutting benefits and taxes. This Republican austerity hit single-income beneficiaries in the belly via rising inflation rates. On average, inflation rates increased by 3.9 percent over this time period. In real terms, this means that each dollar earned in 2002 was being cut by 1.9 percent (3.2 percent minus 3.9 percent), or roughly $112 in purchasing power.

This $112 problem is compounded by the fact today’s Social Security spender is different than it was in 1972 when the program was first enacted. Salary increases implemented since that time have dramatically increased the purchasing power of one’s Social Security income.

If inflation is left unchecked, it will become a bigger problem over time.

What To Do if Interest Rates Spike

In the past years, Inflation has been increasing. It has faced considerable criticism for enabling risky financing of businesses and making it difficult for people who like to save, like most retirees.

Companies have been utilizing inflation accounting by continuously shifting massive amounts of expenses into the future. The government and its representatives in controlling banks, spokespersons, academics, and so on, made it quite difficult to intervene in these activities.

It’s been a winning strategy so far. The central banks cut interest rates a lot since the financial crisis, allowing them to keep outfalling, while trading places of responsibility with the government.

Now, how can you cope with this?

You should fully understand the true impacts of inflation and ignore all the false perceptions like deflation.

In the long run, inflation and deflation have effects on the growth of the economy. No matter how small they are individual, over a longer span of time, these effects will become more pronounced and raise concerns over the state of the economy.

1. Inflation and Deflation seem to be harmless but in reality, it is more harmful than you can imagine. This can cause people to miss/ignore early warning signs and jump into get-rich schemes

You will definitely not see all the effects of inflation until you are struggling with its deep-rooted impacts.

2. Inflation can be a great deal or just a small amount, it all depends on your situation

If you are a person who has enough money to survive, you won’t feel the impact of inflation. However, if you are a single parent or a senior citizen with little or no money, you will suffer a great deal of price increases.

If you have a pension or an annuity, it will also be affected by inflation.

3. Inflation will impact your purchasing power

Inflation can impact your finances in a number of ways, but there are steps you can take to help minimize the impact. By planning ahead. Using some key tools, you can protect your finances and even help to reduce the overall impact of inflation.

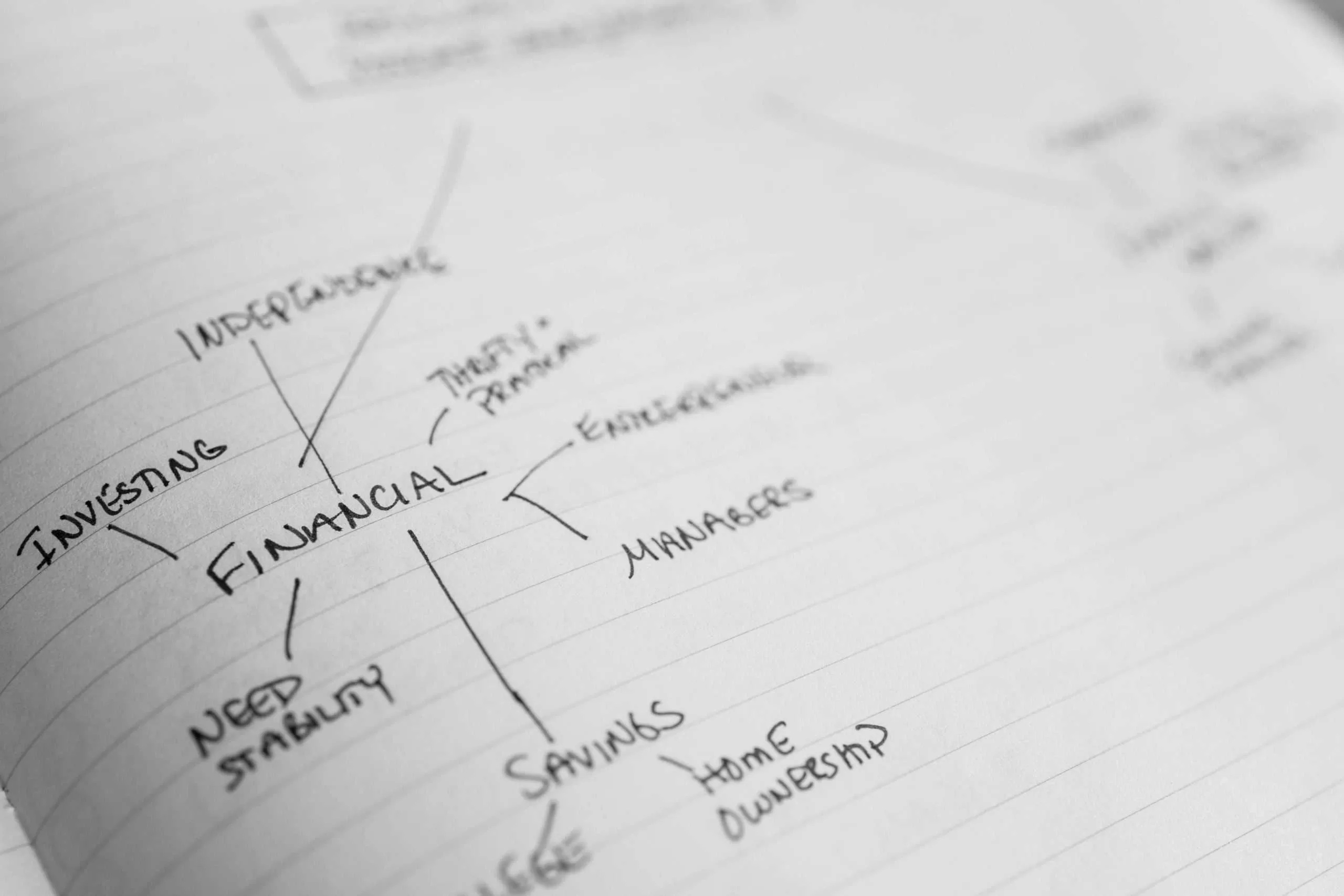

Planning Is Key to avoid inflation

Planning how to avoid this crisis time. Learn about the basics of financial planning, including tips on how to avoid this crisis and stay ahead of the curve.

Financial planning is one of the most important aspects of life. Without a plan, you are likely to find yourself struggling in difficult times – or even worse, facing bankruptcy. By following a few simple steps, you can create a roadmap for your finances that will help you stay afloat during tough times and protect your hard-earned money.

The first step in financial planning is understanding your income and expenses. This may seem like common sense, but many people do not take the time to tally up their outgoings each month. Once you understand this you can beat this. Learn more from warren buffet’s tips.

Planning Ahead

First of all, it is important to recognize that the overall impact of inflation is smaller than it seems. Simply put, you want to make sure to maintain a balance between spending and saving to limit any increase in your bills caused by inflation.

Many main factors can affect your finances. Examples of these factors include but are not limited to, interest rates, the stock market, consumer spending patterns, and the unemployment rate.

Many types of institutions like partnerships, trusts, obligations, mutual funds, insurance, sub-advancer, and banks will also move with an increase in prices. As long as you are careful about your financial situation at the moment by continuous savings and proper investment, you can minimize the impacts of inflation.

Conclusion

Looks like an It’s no secret that planning is key when it comes to protecting your finances. Look like the years of chronic inflation was coming since 2020.

This is why you need a long-term wealth plan. A wealth strategy to make good financial decisions. The best way, make sure to get a good financial advisor. The value of an investment should give you the financial goal. The investment strategy to avoid the impact of inflation.

The federal reserve is trying to help decrease the interest rate as well as the inflation rate. Therefore, the increase in prices will be for a while. Using the key weapons we gave you here should help your investment strategy. Knowing the basics of financial planning, including how to create a budget, save for retirement, and protect your assets from inflation.

Thanks for reading and let us know how you like this. What is your plan for avoiding inflation?

Comment below!

Read similar articles here: